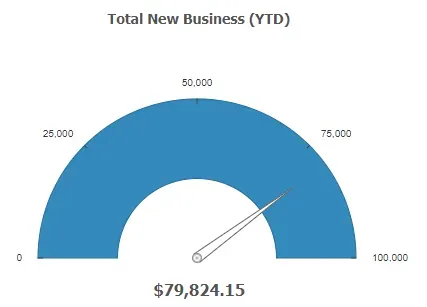

Perrysburg, OH – Equilibrium Insurance Partners, L.L.C., a Perrysburg based property and casualty insurance brokerage achieved moderate Q1 2023 results with $79,824.15 of Direct Written Premium (DWP). Eight new clients were added, four commercial lines and four personal lines clients.

Wisconsin-based West Bend Mutual Insurance Company led the way with all four commercial lines wins totaling $61,746 DWP. Three of those wins were in the auto services industry and one in hospitality. Half of the wins were in our home state of Ohio and the other half in Michigan.

Michigan-based Frankenmuth Mutual Insurance Company was the front-runner with all four personal lines wins totalling $16,625 DWP. All four personal lines wins were in Michigan.

Equilibrium Insurance Partners officially launched on October 10th, 2022, however, the idea had been planned since early 2022. “In February [2022] I started tinkering with the idea of creating an agency from scratch,” said MacGregor (Mac) C. Howey, Founder. “I went to my West Bend marketing rep at the time with my vision and ultimately to see if she would give me an appointment – and without hesitation – she said yes.” Mac continued, “My previous success with West Bend really helped in getting that first appointment. I was the only one really writing with them and we had just passed a $1 million dollar book of business,” he explained. “I knew our loss ratios with them were great, identical 13.4% loss ratios in 2020 and 2021 to be exact, so yeah, I made it hard for her to say no,” Mac smiled.

Frankenmuth was added on January 1st, 2023 for personal lines only. “That was huge,” said Mac. “It gave us the ability to be multi-faceted. Now we have West Bend for commercial lines and Frankenmuth for personal lines.” But Mac recognized that writing with only “one crayon” for each type of business would be tough, and recently expanded his product offerings to include WestGUARD Insurance Company, backed by Warren Buffett’s Berkshire Hathaway. “Our appetite and growth goals align well, so expanding our product offerings to include GUARD was a no brainer,” explained Mac.

Equilibrium has been able to keep start-up costs extremely low by staying 100% digital. The operation is ran out of the second bedroom of Mac’s Perrysburg apartment. “Our annual business expenses are projected to be around $10,000 for 2023, and our commissions receivable for this quarter alone should be just higher than that, so we are already break-even for 2023,” Mac smiled.

Equilibrium had 15 appointments in the first quarter of 2023, three of which were walkaways (lack of positive catalysts to continue quoting). Of the remaining 12 appointments, three were declinations, all of which didn’t meet carrier appetite guidelines. That left us with nine true quoting opportunities, and we closed on four of them (44% hit ratio).

Auto services had a perfect hit ratio of 100% (3 for 3). One of those auto service wins included a nice fleet of tow trucks. Hospitality also had a perfect hit ratio of 100% (1 for 1). Among the least successful industries quoted included golf courses (0 for 1), condominium associations (0 for 2), and daycares (0 for 2).

“The golf course account bummed me out the most. We were about $2,000 lower than the incumbent but couldn’t match their tree debris removal limits of $25,000 per tree,” said Mac. Mac continued, “The golf course had some trees that were over 200 years old – massive trees – and my carrier limited the tree debris removal limit to $1,000 per tree. It was a pain point for the insured that cost us the account.”

Mac concluded by saying he was actually offered an agent-of-record (“AOR”) letter due to his technical expertise in Ordinance or Law insurance, but he didn’t have the incumbent carrier to execute. “Basically, they had a 52-year-old clubhouse, and after adding up the rough costs for over 50 years of building code upgrades – including a full fire suppression system and significant ADA upgrades – they were well short of coverage,” said Mac. “That impressed them enough to ask how I could become their agent, I explained the process, but ultimately that I couldn’t do it because I didn’t have their current insurer.”

For all insurance quote requests in Greater Toledo and Metro Detroit, please call 419-386-0870 or contact us here.

About Equilibrium: Established in 2022, Equilibrium Insurance Partners is a property and casualty digital insurance agency. Based behind the founding principal of the Equilibrium Insurance Point, Equilibrium’s job is to find each client’s balancing point, that is, where price and coverage intersect. Some insurance consumers are more price conscious, while others are more coverage conscious. At Equilibrium, it’s our job to figure out which type of consumer you are and tailor an insurance program to fit your individual or business’ needs.

Recent Post