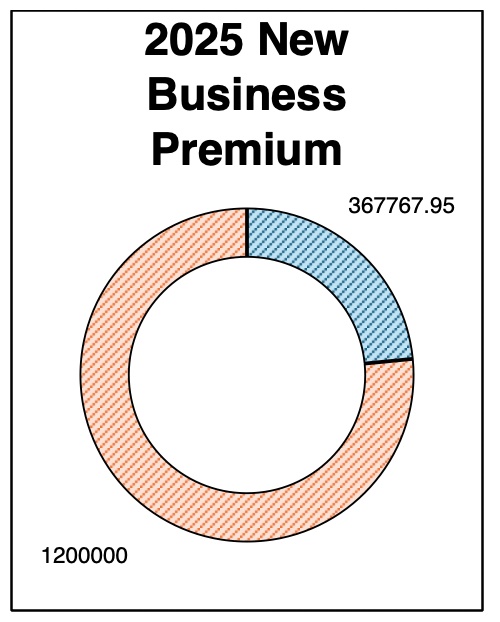

Perrysburg, OH – Equilibrium Insurance Partners, L.L.C., a Perrysburg based property and casualty insurance brokerage achieved record-setting Q1 2025 results with $367,767.95 of new written premium. Twelve new clients were added, ten commercial lines and two personal lines clients.

New commercial lines premium totaled 98% of the new business, totaling $364,047.95 in premium. Five of the ten wins came within our real estate vertical (hotel/motel). Other wins included one of each of the following: condo association, golf course, manufacturer, towing , and NEMT.

Wisconsin-based West Bend Insurance Company led the way with $201,759.00 in Direct Written Premium (DWP). From a personal lines perspective, Michigan-based Frankenmuth Mutual Insurance Company led the way with all wins totaling $4,689 of new Direct Written Premium (DWP).

From the brokerage side of the business, Ohio-based Novum Underwriters, which has both admitted and non-admitted products, was at $101,855.00.

Our 2025 goal is to write $1,500,000 in new business premium, with at least $1,000,000 of that coming from the standard marketplace. With the amount of hotel/motel referrals coming into the door, that may be a far fetch.

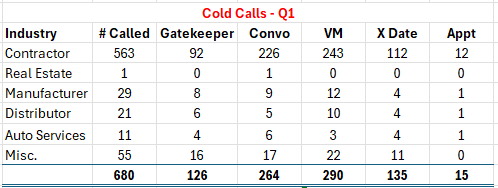

In other news, our Founder Mac is also doing a cold call challenge. He’s trying to make 15 cold calls per day, which usually takes about 2 hours. At 225 working days per year, that’s 3,375 cold calls. Here are is Q1 cold calling results.

If you are interested in getting a second opinion on your insurance program, whether home, auto, or business, please reach out. For insurance quote requests/due diligence in Greater Toledo and Metro Detroit, please call 419-386-0870. For insurance quote requests/due diligence in Petoskey, please call 231-758-5271. Additionally, you may contact us here.

About Equilibrium: Established in 2022, Equilibrium Insurance Partners is a property and casualty digital insurance agency. Based behind the founding principle of the Equilibrium Insurance Point, Equilibrium’s job is to find each client’s balancing point, that is, where price and coverage intersect. Some insurance consumers are more price conscious, while others are more coverage conscious. t Equilibrium, it’s our job to figure out which type of consumer you are and tailor an insurance program to fit your individual or business’ needs.